Overdue GST & Income tax

Due to many unforeseen circumstances small businesses usually lag behinds on paying taxes. Once taxes become overdue, then IRD start chasing you with phone calls & letters, this leads to unnecessary stress & downtime in your business. The longer client leaves the situation the interest & penalties starts to pile up which creates more debt.

How we can help:

When a new client approaches us with this issue, firstly we link client to our tax agency & inform IRD that Swift Accounting will be dealing on their behalf. This instantly stops further letters & phone calls coming to client. IRD is also made aware of expected GST & Income Tax payments.

Solution:

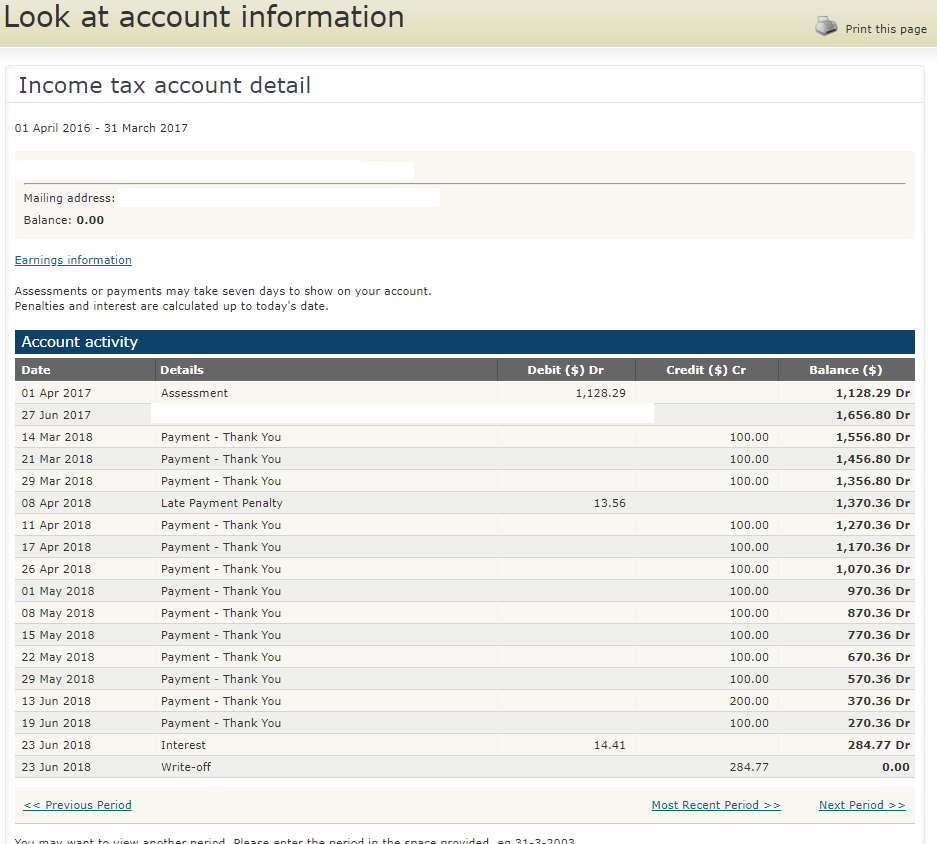

We act with IRD on your behalf & prepare proposal for IRD to pay taxes in instalments. Most cases IRD has accepted the proposal & client has happily paid off the debt.

Recent Cases:

Case of Riccarton Cleaning Service:

A cleaning company in Riccarton never registered for GST, but was issuing invoices, previous accountant never registered for GST & client was under impression that they were GST registered.

After approaching Swift Accounting, we registered client for GST & run backdated GST returns which created a huge bill, after our proposal to IRD was accepted client happily paid all GST due in fixed weekly Installment. Client disclose all the information & wasn’t charged any further penalties & Interests which could amount to $5000.

Small Contractor, Linwood:

A small contractor from Linwood approached Swift Accounting which never bother to submit tax returns from past 2 years, IRD was chasing, he didn’t have any receipts, all Income was in his bank accounts. Client was unable to apply for WFFFTC .

After analyzing his situation, we requested IRD for extension which was accepted, His tax returns were filled in 7 days, & he had very minimal tax liability.